Founded in 2009, IndoStar is an NBFC registered as a non-deposit taking company with the Reserve Bank of India. They are noted in the Finance Industry for providing structured term financing solutions. They administered a research and concluded that individuals in rural areas and those categorised under the unorganised sector did not have access to loan facilities. They wanted to develop a medium to get in touch with such individuals to make loans available to them via the app they wished to create, i.e., IndoLoan.

Location

Mumbai, India.

Industry

Finance

Challenge

Business

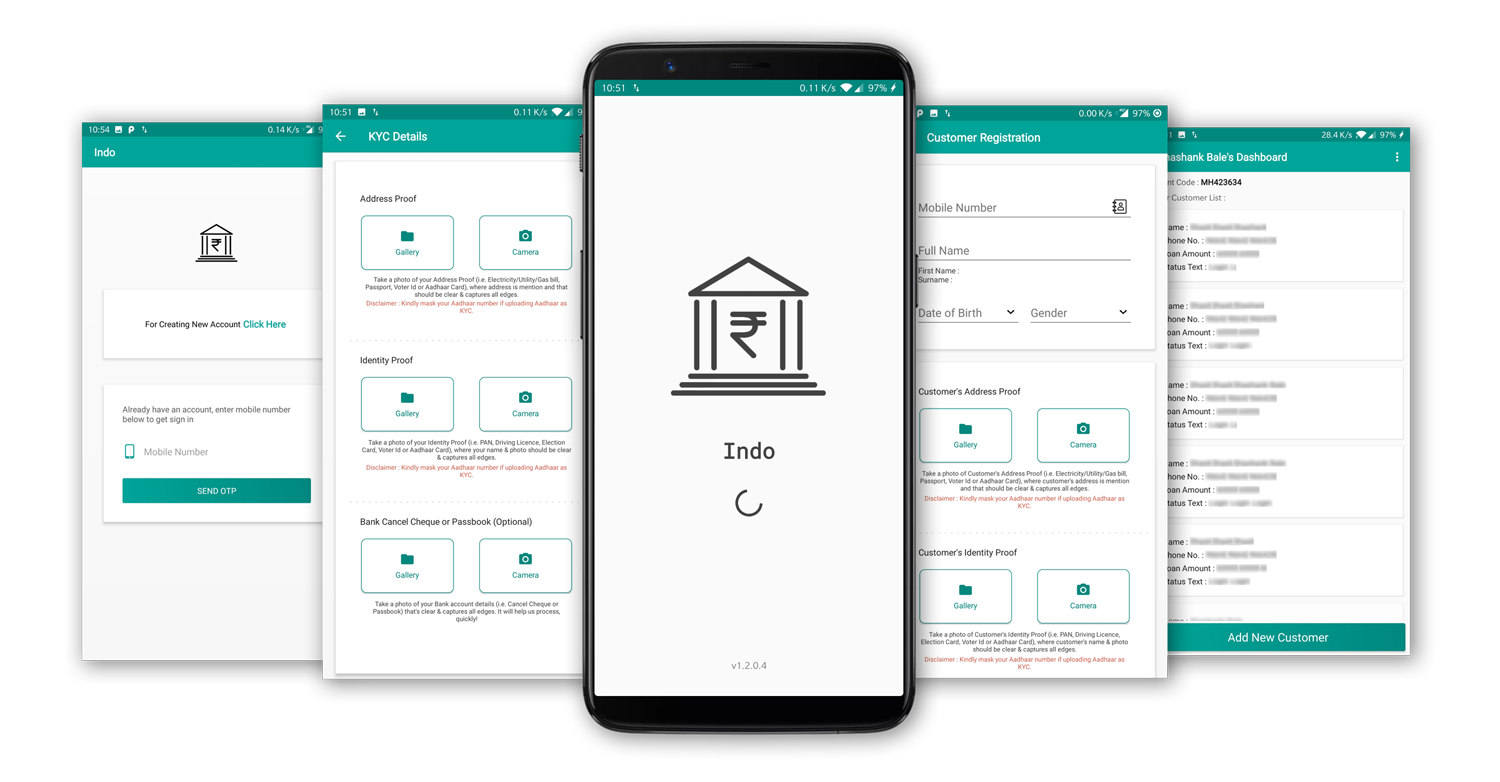

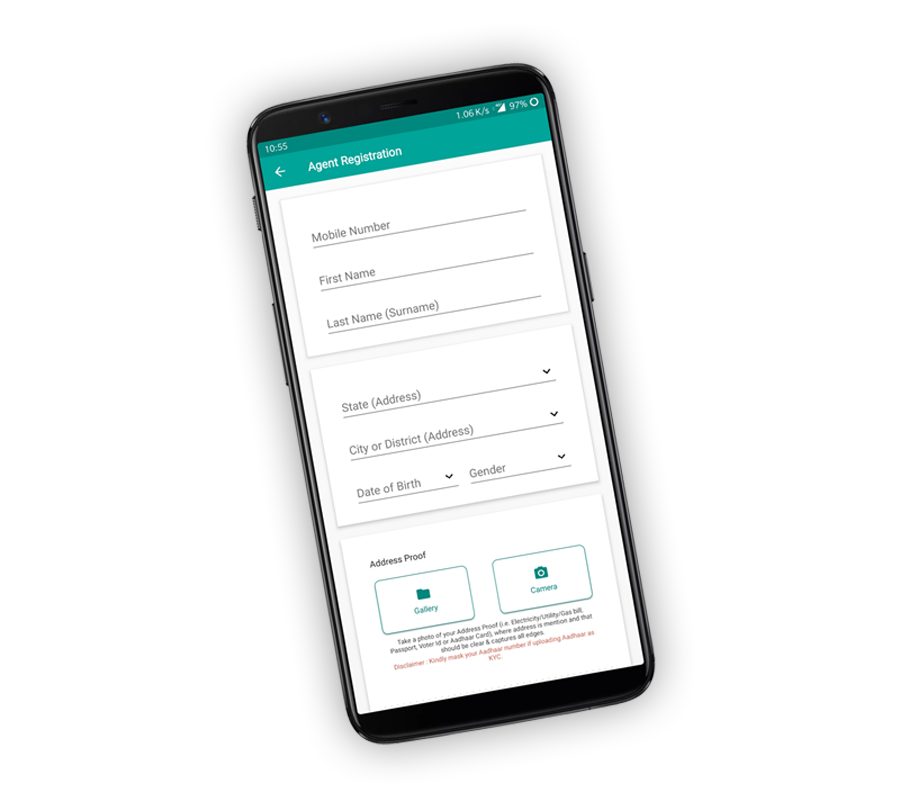

Our client came up with an idea to create an application that would cater to the potential customer in need of a loan as well as the individual responsible for collecting the data of such customers (agents). Through this app, they would be able to empower their agents in the rural areas to get accurate information of prospective customers looking to start small to medium businesses. The main concern was the ability to identify authentic profiles (for both the agent and the customer) from fictitious ones.

Technology

Since the target customer base was primarily individuals belonging to rural areas, the need, therefore, was to create an extremely easy to use mobile application and further enable the collection of required information for the backend team. Moreover, a sparse budget for the project limited possibilities. We had to take a call on whether to choose Firebase-Platform or Custom-Server-side-Processing for:

- Generating Daily Reports,

- Creation of a dynamically customizable database structure,

- Timely updates to the Client ad Users via Email & SMS,

- Taking backups at required intervals.

Solution

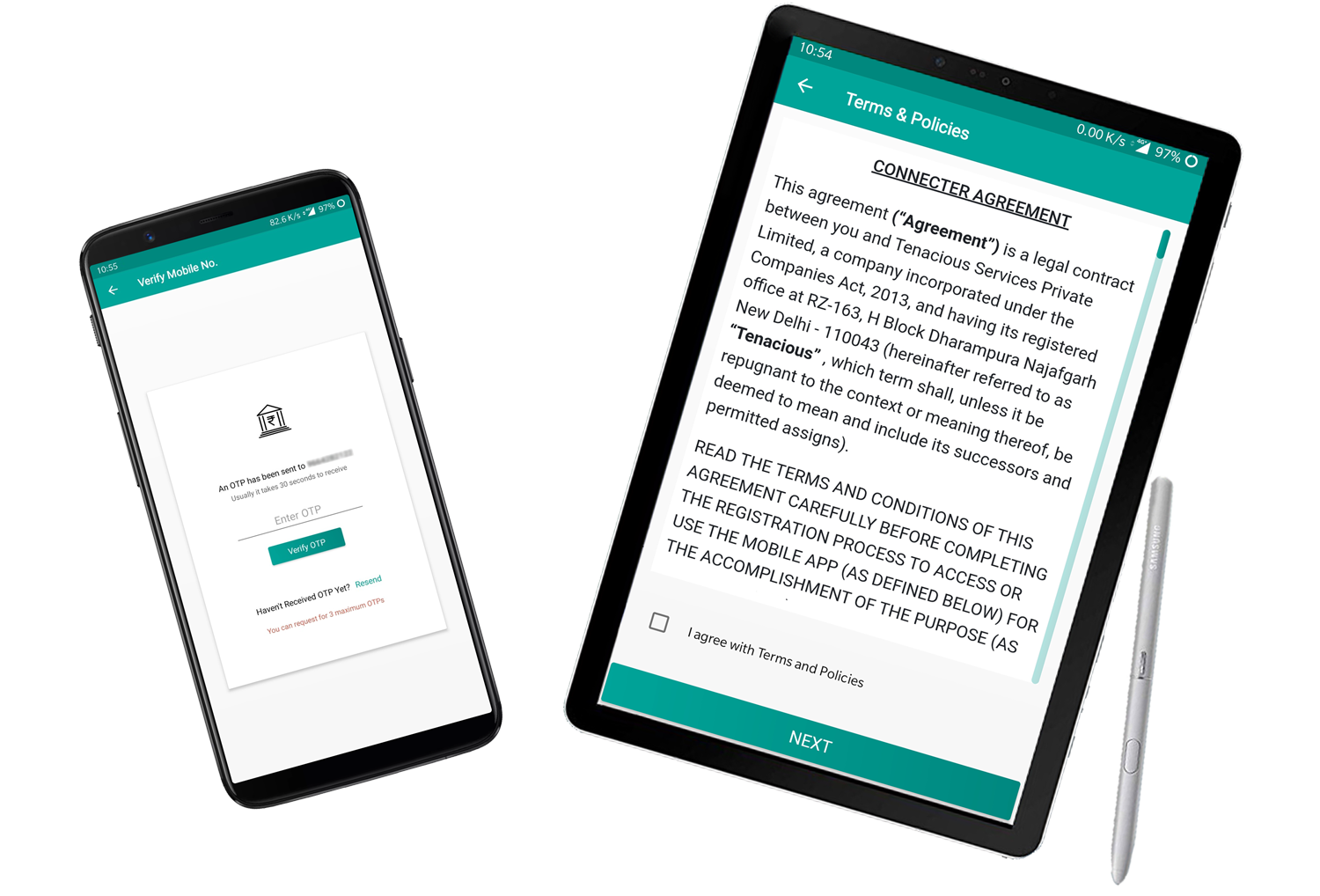

Our journey to develop the IndoLoan Android App for agents and customers started with the wireframing and technical designs. We created the app process to be such that the potential agent would be required to be registered on the app along with necessary documents. This data would go back to the server window clone, and the person will automatically be verified whether he is a genuine person or not. The same would be applied to customers for a many times; there are fake data inputs. On approval, when the loan is disbursed to the customer, the agent would get rewarded simultaneously. Maintaining a detailed track of requests and managing the backend process verification would be challenging with a Firebase Platform; therefore, we decided to proceed by creating our own sophisticated yet straightforward server.

Services

- Android Mobile App Development

Technology Stack

- Java

- Kotlin

- Firebase

- Crashlytics

- Remote Configuration

Results

Excellent turnover

Achieved 4K+ Downloads

Let’s talk about your project

So let's get in touch and turn your idea into a brilliant software solution. You will get a bespoke proposal within 24 hours.